Value Network Mapping

An Example

In the last episode, “What is a Value Network? "We introduced Value Networks, a mapping and modeling technique that helps us understand the relationships between the flow of value and work in complex systems.

Value Networks were introduced and developed by Verna Allee, who described them as follows.

“Value networks are the natural way people organize to achieve outcomes. If you define a value network as any set of roles and their interactions that create a specific business outcome, then anything we do together is a value network.

Value networks put people at the heart and center of value creation.”

Her book Value Networks and the True Nature of Collaboration remains the definitive reference. I highly recommend it for a more detailed understanding of the modeling technique and its applications.

In this episode, we’ll work through a detailed example of value network mapping.

I based the treatment here on how I have applied the concepts in the software product development space. In doing so, I have extended some of the core concepts in Verna Allee’s formulation, in some cases, to serve my needs while, I believe, staying true to the original intent.

I welcome constructive feedback on this approach, as it is an evolving practice.

Definitions

We can construct a Value Network from three simple primitives: Roles, Transactions, and Deliverables.

Roles represent (groups of) people and their contributing roles in a collaboration that creates value for the participants. Arrows between roles represent transactions that exchange something of value between the roles.

Value network mapping aims to identify the roles, transactions, and deliverables in collaborations that create value. It places people and their interactions at the heart of the value-creation process.

From this seemingly simple set of primitives, rich contextual models can be created that illuminate the relationship between the flow of value and work in product development at different timescales and levels of detail.

A key feature of value networks is that the “deliverables” exchanged in this transaction may be tangible or intangible. In practice, intangibles constitute a significant component of the “flow of value.” By modeling them explicitly, value networks allow us to build much richer models for value creation.

Mapping a Value Network

The first thing to note about Value Network maps is that they are not unique.

The map you build depends entirely on the purpose of the mapping exercise, including the specific questions you want to answer and the context and boundaries of the system you are examining.

All value network maps share the common feature of focusing on the interactions between roles via transactions, with deliverables being the explicit representations of value exchanged, tangible or intangible.

Value Networks are expected to be highly context-specific and should focus on clarifying the collaboration structures that lead to value-creating outcomes. You should feel free to construct suitable value networks to answer your specific questions.

That said, seeing familiar contexts, granularities, and examples of value networks can help build intuition, and this post offers some examples of what’s possible. While the example we show here has a natural generalization, which we will describe and explore later, I believe there are many more ways to map and model value networks, starting from the basic definitions above.

Therefore, our example should not be considered a definitive way to map or model value networks; it is just an illustration of the concept's generality and the kinds of questions you can answer using these techniques.

If you find the approach intriguing, please explore and share any new insights you uncover by trying other methods to map value networks.

I believe this is an area ripe for exploration and experimentation.

The Example

AssetManagerPro is a SaaS product that helps commercial property owners manage small to mid-sized real estate portfolios.

The value proposition:

“AssetManagerPro empowers small to mid-size commercial property owners and asset managers with an all-in-one platform that simplifies both financial management and operational logistics with a user-friendly, scalable solution tailored to your specific needs, providing real-time insights into rental income, property metrics, and maintenance workflows—all in one place, at a cost that fits your budget.”

The Value Network Mapping for Asset Manager Pro shows how the product generates value within its ecosystem and connects this to the flow of work needed to achieve the flow of value.

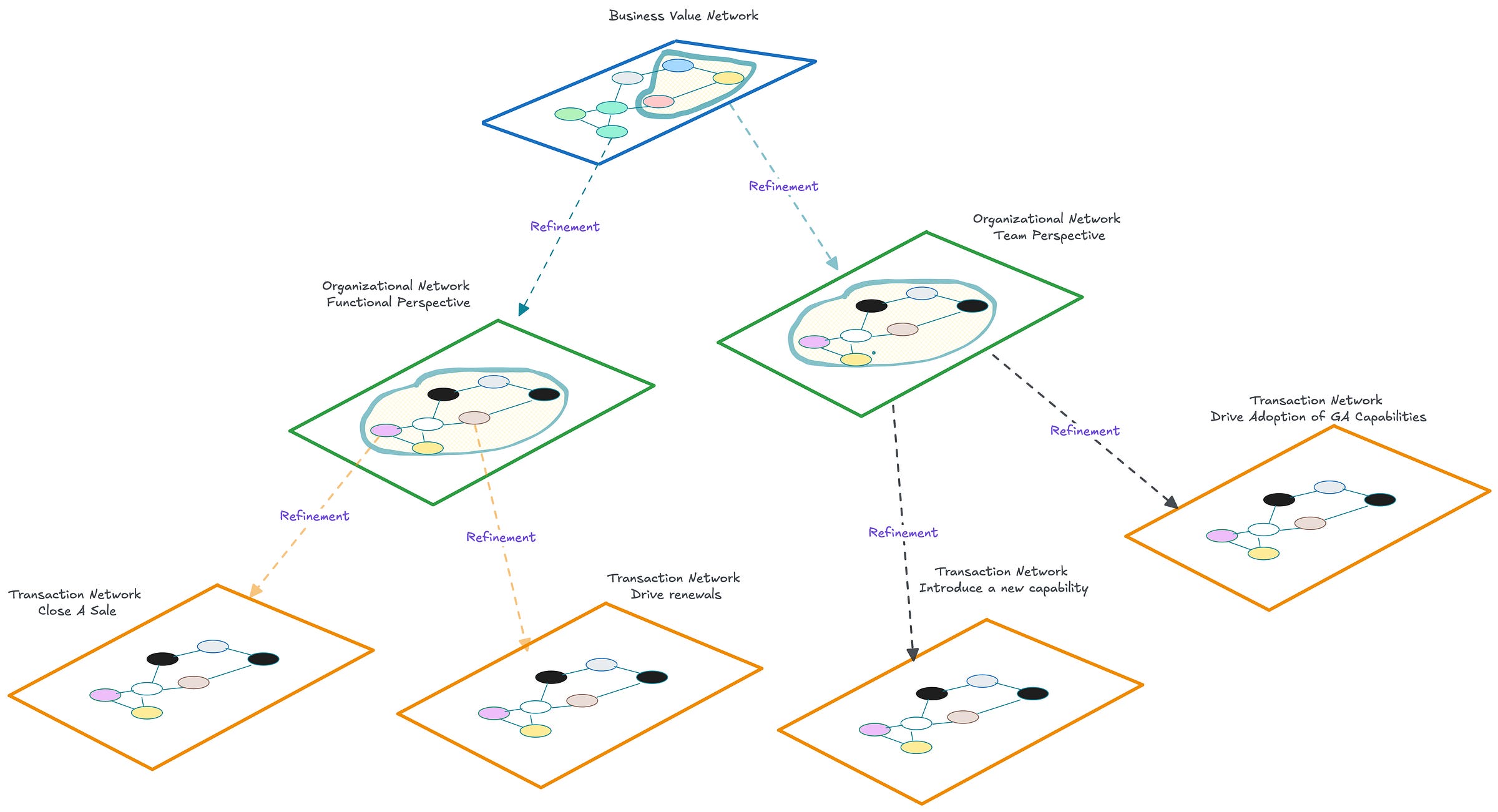

We will construct the map at three levels of detail.

The Business Value Network

At the top level of the value network map, we consider the business ecosystem in which Asset Manager Pro operates.

The business value network represents value-creating collaborations among the company, its customers, and partners. Competitors are also modeled at this level, though not included in this example.

The business value network models the flow of value. We orient our questions about value creation around the focal roles of the business, its customers, and its partners.

Figure 3 shows the business value network for Asset Manager Pro

There are three categories of roles.

The first is the AssetManagerPro, the focal provider role in this network.

The second key set of roles represents the consumers1 who might derive value from the product. We have chosen to model these as four separate roles roughly mapped to the product's customer journey.

Target Market: The set of all potential consumers of the product

Prospects: Consumers who have shown interest in the product.

Customers: Consumers who have purchased the product.

Former Customers: Consumers who no longer use the product.

Segmenting a population (consumers, in this case) into multiple roles helps model the dynamics of value creation. Interactions between the AssetManagerPro role and the four consumer roles help uncover different value-creating transactions between providers, consumers, and other players in the ecosystem.

The third set of roles includes partners, such as distribution partners, marketing channels, industry conferences, and product review sites. This ecosystem broadens the opportunities for consumer exposure to the product, driving more value exchanges between providers and consumers.

The business value network is the ecosystem in which AssetManagerPro exchanges tangible and intangible value with other network players.

For example:

Customers gain direct value from using the product (tangible) and, in return, pay subscription fees to the provider (tangible).

Large distribution partners offer market access to the provider (intangible) in exchange for a share of product revenue (tangible) and added value to the partner-customer relationship (intangible).

Providers gain referral value from satisfied customers promoting the product (intangible), and consumers receive insight from candid negative reviews left by dissatisfied former customers (intangible).

Marketing partners run campaigns on behalf of the provider (tangible) in exchange for marketing fees (tangible).

The value network above reveals many more such value exchanges.

The Flow of Value

Transactions in the business value network represent fundamental value exchanges that drive the flow of value within the network.

Metrics such as subscription fees, referral counts, and revenue share percentages provide quantifiable insights into the tangible and intangible exchanges between AssetManagerPro, its partners, customers, and prospects. These can be traced back directly to transactions in the value network.

We can also track the flow of value over time by analyzing population dynamics of roles—such as prospects converting to customers or customers becoming former customers. These population shifts reveal trends in consumer behavior, satisfaction, and brand loyalty, indicating value created or lost.

Combined, transactions, metrics, and population dynamics enable causal modeling of value movement within the network, identifying potential collaboration bottlenecks and uncovering opportunities to enhance value creation.

Consider sales-related transactions in the AssetManagerPro ecosystem as an example.

Standard sales metrics, like closing rate, revenue per customer, and customer acquisition cost, measure success rates and can be traced back to transactions within the business value network.

In the value network model, these metrics are also reflected in observable population shifts between the Prospect and Customer roles, serving as leading indicators of changes in sales performance. Each successful transaction converts a Prospect to a Customer, reflecting the tangible flow of value and showcasing the network’s sales effectiveness. Each failed transaction brings opportunities to reflect on the structural changes needed to improve the probability of success and increase the flow of value in the network.

Subsequent posts will focus on modeling and measuring the flow of value in much greater detail.

However, for now, let’s continue mapping the value network.

Refining Value Networks

Given a set of roles and transactions in the business value network, we can refine2 it to produce a new value network.

These refined value networks focus on modeling the collaborations needed to execute value-creating transactions within the original network and capture detailed interactions across roles in the parent network.

In a refinement operation, we replace some roles and transactions in the parent network with new ones to represent more detailed interactions between those roles and the relevant roles in the parent network.

This layered approach can extend to multiple levels, with each refined network representing more details about the flow of collaborations that drive successful outcomes and enhance the overall value flow in the top-level business value network.

In our first example refinement, we focus on the value exchanges between the AssetManagerPro and Customer roles in the original business value network.

We’ll refine the AssetManager Pro role to a set of departmental roles and add transactions to define the interactions of the new roles with the existing customer roles.

Figure 4 shows the refined value network.

It shows the collaborations between AssetManagerPro at a departmental granularity and each of the four customer segments focused on the customer journey in the business value network3.

We'll call it the “Consumer Value Network.”

Transactions in the network drive the flow of consumers between segments. It takes close collaboration between marketing, sales, and product development to move a consumer from the target market to the customer role. The value network above allows us to visualize and reason holistically about all these interrelated collaborations between departments and the transactions between the departments and consumers in various segments.

A critical difference between the value network perspective is that it is not necessarily limited to the boundary of a single company or organization within it. Instead, we look at the collaborations and deliverables needed to achieve specific outcomes even when they cross traditional functional and enterprise boundaries.

Let us consider one more refinement of the network: the “Buying” transaction in the consumer value network.

We will refine the portion of the consumer value network below anchored around the buying transaction, which moves consumers from Prospects to Customers. In the AssetManager Pro context, closing a sale involves both the Sales and Product Development departments and potential referrals from existing customers.

A successful Buying transaction provides tangible value to the company and the consumer. Even unsuccessful transactions can provide intangible value signals to both departments that help refine the ideal customer profile and the product capabilities that a consumer might find lacking in the current product.

Let us now refine this portion of the value network to detail the collaborations needed to facilitate successful buying transactions.

Figure 6 shows the resulting value network.

The refined network shows the collaborations needed to close a deal and convert a consumer from Prospect to Customer. We'll call this the Collaboration Network for the Buying transaction.

There are a few things to note about the refinement.

The Prospect role in the customer value network has been refined into four roles, with a single focal role called the Asset Manager role. This role represents the consumer side value recipient of this collaboration.

Additional refined consumer-side roles include financial controller, purchasing team, and IT team, representing other stakeholders who have a say in the successful outcome of a buying transaction in a consumer organization.

On the provider side, we have refined the sales and product development department roles into more granular roles that represent the specific roles needed to successfully close a deal for AssetManager PRO. These refine roles in sales and product development departments.

The provider roles, such as Demo Giver, Deal Owner, etc., are generic and designed to indicate the role's responsibilities in the collaboration. It is important to note that these roles are not job titles nor imply that different people must play them. The same person may be a Demo Giver and the Deal Owner on any given sales deal, and different people may assume these roles for different deals.

The critical point is that refinement focuses on transactions between consumers and providers and the collaborations between roles on each side needed to complete a transaction successfully. The refinement preserves the principle of adding detail to collaboration between roles in the network being refined.

The activity network is a bridge representation between the flow of work and the flow of value. It identifies what cross-functional transactions between roles are needed to successfully close a deal (the value-creating transaction) without necessarily specifying the detailed steps required to execute those transactions. That next level of detail usually belongs to more detailed process mapping techniques.

Buying transactions can activate this network in various sequences. Rather than tracking each possible sequence, the network representation emphasizes the key roles and interactions common to all company sales transactions. Sequencing, however, can be applied to the transactions in the collaboration network to create a more process-centric view of the activity network.

Depending on how we model value streams, sequences in the activity network may also correspond to value streams, providing a natural bridge to value stream mapping. For example, mapping the above collaboration network as a Demo-Close value stream would be perfectly consistent with current value stream management practices. However, it should be apparent that the collaboration network focuses on the people and interactions required to achieve a successful outcome rather than the end-to-end workflow of steps, resources, etc, needed to do this. The latter is the domain of value stream mapping or other process mapping techniques.

VDML provides first-class representations of sequences in a value network, providing a formal bridge between the value network representation and more process-centric views such as value stream maps.

The General Picture

I want to re-emphasize that the mapping approach we have taken here is but one possible way to use the very general concepts behind value networks.

That said, I've found that my approach of defining a top-level value network with roles and transactions between a company and its external customers, then iteratively refining key roles and transactions at the department/team and transaction levels to link work processes to the flow of value, is promising.

Figure 7 outlines the general picture.

Throughout the rest of the season, we will expand on these mapping techniques and offer detailed examples that connect value network mapping with other established methods for enhancing visibility, decision-making, and impact on software product development flow.

Up Next

In the next episode, we’ll explore the relationship between value network mapping and value stream mapping. While value streams and value stream mapping are well-established for workflow optimization, I contend that, for software products, these models don’t fully connect the flow of work to the flow of value.

I’ll argue that value streams organically emerge from the flow of value within a value network and are dynamic constructs in the complex realm of software development. The business value network represents the more natural and stable structure of value-creating collaborations from which value streams arise.

Now that we have a concrete example of a value network in a software product context, we can make this argument.

We use the word “consumers” here in contrast to the “provider” role the business plays in this network. You should not interpret this to mean that consumers are individuals.

The definition of refinement I present here is not in the original concepts in Verna Allee’s book. However, related ideas are alluded to in her work and are consistent with related concepts in VDML.

The departmental refinement is based on how AssetManagerPro is organized today. We are looking at the company's operating model at this level of detail.